Supply & Demand: The Economic Cornerstone

In the past 15 years the real estate market has seen the highest of highs and lowest of lows. While the factors governing these changes are manifold, they all in one way or another influence the most basic of economic principles: supply & demand.

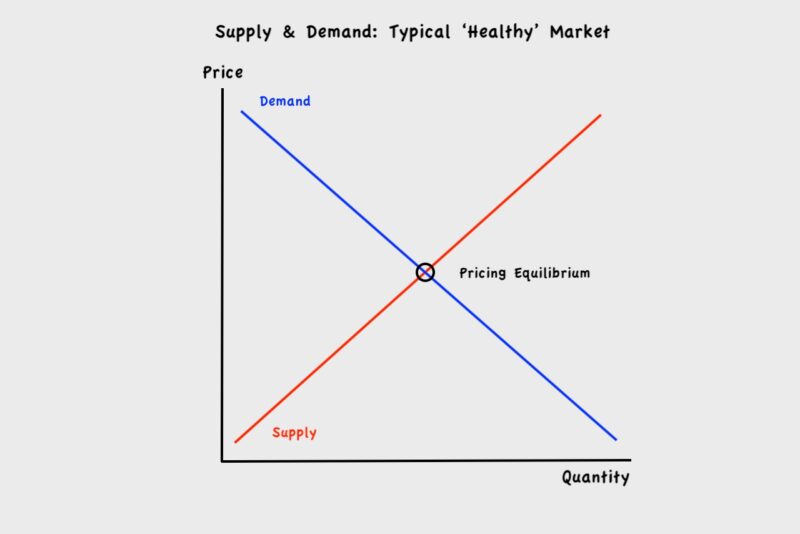

In a ‘healthy’ market supply and demand are in a constant exchange, which establishes a pricing equilibrium:

In the mid 2000s permissive lending practices lead to a housing bubble, which burst dramatically in 2007-2009. In the years following supply exceeded demand.

When supply exceeds demand prices must drop for the frequency of sales to remain active:

A consumer spending zeitgeist followed the pandemic lockdown of 2020, which depleted the housing market.

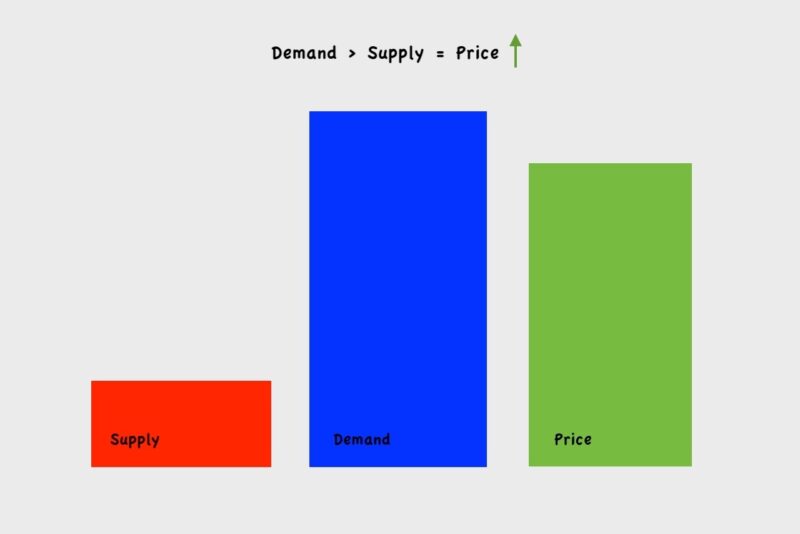

When demand exceeds supply prices rise because consumers are generally willing to pay more for that which is desirable and scarce:

Exclusivity: A Stabilizing Factor

Traveling east along Route 6 one notices a pronounced narrowing of the land near the Eastham/Orleans line, which continues into Provincetown. Based on scale it’s clear there must be less real estate in this region than other parts of the Cape, and certainly less than in many localities off Cape. The above graph showed the effect of limited supply on price, but it assumed an outside influencing factor (in this case the pandemic). Here, I draw a distinction between that and that which I call intrinsically (or naturally) limited, and refer to the latter as the ‘exclusivity factor’.

I define ‘exclusive’ as follows: a desirable (perhaps non-essential) item which by its nature is limited and therefore somewhat difficult to obtain. Note that based on this definition gold would qualify as exclusive as it is a limited commodity, but Las Vegas real estate would not due to an abundance of available properties at any given time (pandemic notwithstanding). Based on my definition Outer Cape real estate qualifies as exclusive, but not all Outer Cape real estate. To satisfy the definition it must be “desirable”. That falling down fixer-upper on Elm Street is a proverbial nightmare regardless of where it’s located.

Exclusivity, which is not to be confused with luxury (luxury purchases confer status and typically are associated with a particular brand or address/zip code), can be a stabilizing factor in a diminishing economy. Recall from the graph above that when demand is high (expanding economy) prices tend to rise. Conversely, when demand is low (diminishing economy) a limited supply may result in greater price stabilization. The reason goes back to supply & demand. A good example is the lack of viable building lots on the Outer Cape. As discussed, the region is small and due to its desirability much of it has already been developed. In Las Vegas, to extend our comparison, many more opportunities exist for developers–therefore, when the economy softens prices must drop further in Las Vegas for the frequency of sales to continue apace. Am I saying that Outer Cape real estate is impervious to economic downswings? Of course not. But a limited supply (i.e., exclusivity) does incline our market toward greater overall stability.

Note also that my definition is inclusive of “non-essentials”. While there are many different types of non-essential items, a home which is not a primary home is a non-essential home. In this case the property owner chose to invest in real estate, but it’s understood that he/she could have invested their money elsewhere. This is an important point and one which is tied to desirability. Investors sometimes see opportunity where others experience hardship. Sustained activity by investors during economic downswings helps to further stabilize and moderate the Outer Cape market.

Summary:

There are many economic and societal factors which influence supply & demand. Exclusivity, it has been suggested, can be a stabilizing factor in a diminishing economy as the combination of desirability and relative scarcity often result in greater price moderation.

Doug

✍